No. S 213

| Income Tax Act |

(CHAPTER 134)

| Income Tax (Concessionary Rate of Tax for Approved Offshore General Insurers) (Amendment) Regulations 2013 |

|

| Citation and commencement |

| Amendment of regulation 2 |

2. Regulation 2 of the Income Tax (Concessionary Rate of Tax for Approved Offshore General Insurers) Regulations (Rg 26) (referred to in these Regulations as the principal Regulations) is amended —

|

| Deletion and substitution of regulation 4 |

3. Regulation 4 of the principal Regulations is deleted and the following regulation substituted therefor:

|

| Amendment of regulation 4A |

| 4. Regulation 4A(1) of the principal Regulations is amended by deleting the words “16th February 2011” and substituting the words “31st March 2018”. |

| Amendment of regulation 4B |

| 5. Regulation 4B(1) of the principal Regulations is amended by deleting the words “31st August 2011” and substituting the words “31st August 2016”. |

| Amendment of regulation 5 |

| 6. Regulation 5(1) of the principal Regulations is amended by deleting the words “Subject to regulation 5A, 7, 7A or 7B, tax” and substituting the word “Tax”. |

| Amendment of regulation 5A |

| 7. Regulation 5A(1) of the principal Regulations is amended by deleting the words “Notwithstanding regulation 5 and subject to regulations 7, 7A and 7B, tax” and substituting the word “Tax”. |

| New regulation 5B |

8. The principal Regulations are amended by inserting, immediately after regulation 5A, the following regulation:

|

| Amendment of regulation 6 |

9. Regulation 6 of the principal Regulations is amended —

|

| Amendment of regulation 6A |

10. Regulation 6A of the principal Regulations is amended —

|

| Amendment of regulation 7 |

11. Regulation 7(1) of the principal Regulations is amended —

|

| Amendment of regulation 7A |

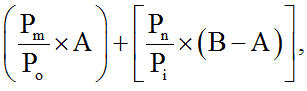

| 12. Regulation 7A(1) of the principal Regulations is amended by deleting the words “regulation 6(1)” in the definition of “Po” in sub-paragraph (b) and substituting the words “regulation 5B(1), with the references to the approved marine hull and liability insurer therein modified to refer to the approved captive insurer”. |

| Amendment of regulation 7B |

| 13. Regulation 7B(1) of the principal Regulations is amended by deleting the words “regulation 6(1)” in the definition of “Po” in sub-paragraph (b) and substituting the words “regulation 5B(1), with the references to the approved marine hull and liability insurer therein modified to refer to the approved specialised insurer”. |

| Amendment of regulation 8 |

14. Regulation 8(2) of the principal Regulations is amended —

|

[G.N. Nos. S 658/2004; S 79/2009; S 746/2010; S 101/2011]

Permanent Secretary (Finance) (Performance), Ministry of Finance, Singapore. |

| [MOF R 32.7.0006 Vol. 22; AG/LLRD/SL/134/2010/11 Vol. 1] |