4. The principal Rules are amended by inserting, immediately after rule 33D, the following rules:| “Re-registration on or after 25th January 2010 of private motor cars, etc., as off-peak cars |

33E.—(1) As from 25th January 2010, the registered owner of the following vehicles may apply to the Registrar for the vehicle to be re-registered as an off-peak car under this rule (referred to hereinafter as a “new scheme off-peak car”):| (a) | any private motor car; | | (b) | any business service passenger vehicle registered using a certificate of entitlement issued on or after 1st April 1998; | | (c) | any private motor car which has been transferred on or after 1st April 1998 to a statutory board, company, firm, society, association or club; | | (d) | any motor car which has been registered as an off-peak car under rule 32; and | | (e) | any private motor car which has been re-registered as an off-peak car under rule 33. |

| (2) An application under paragraph (1) shall be made in such form and manner as the Registrar may require, and shall be accompanied by a fee of $100. |

| (3) The Registrar may impose such conditions as he thinks fit when granting an application made under paragraph (1). |

(4) Subject to paragraphs (6), (7) and (8), the registered owner of a vehicle referred to in paragraph (1)(a), (b), (c) or (e) in respect of which any applicable conversion premium under rule 33(5) or 33F(4) (as the case may be) has been paid to the Registrar shall —| (a) | for the initial period of 6 consecutive months beginning from the date of the re-registration (referred to hereinafter as the “eligibility period”) during which the vehicle continues to be a new scheme off-peak car; and | | (b) | for each subsequent period of 6 consecutive months or part thereof (referred to hereinafter as the “rebate period”) during which the vehicle continues to be a new scheme off-peak car after the eligibility period, |

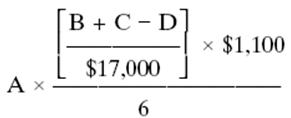

| be entitled to a rebate of $1,100 or of an amount calculated in accordance with the formula set out in paragraph (5), whichever is the lower. |

|

(5) The formula to be applied for the purposes of paragraph (4) shall be as follows: | | | is the period (in months) during the eligibility period or any rebate period (as the case may be) for which the vehicle continues to be a new scheme off peak car; |

| | | | is the quota premium payable under the Road Traffic (Motor Vehicles, Quota System) Rules (R 31) for a certificate of entitlement in respect of the vehicle; |

| | | | is the fee payable under rule 7 in respect of the vehicle; and |

| | | | is the rebate granted by the Registrar under rule 9A or 9B in respect of the vehicle. |

|

|

|

(6) The Registrar shall pay the rebate provided for under paragraph (4) to the registered owner of a new scheme off-peak car at the end of the eligibility period or each rebate period, as the case may be, except that —| (a) | if within the eligibility period or any rebate period the new scheme off-peak car attains the age of 10 years or is de-registered, the rebate for that period shall be payable to the registered owner of the vehicle on a pro-rata basis upon the happening of the event; | | (b) | if within the eligibility period or any rebate period the new scheme off-peak car is —| (i) | reported as having been lost through theft or criminal breach of trust; or | | (ii) | seized by any authority under any written law, |

|

| the Registrar may, upon the expiry of that period and subject to such conditions as the Registrar thinks fit to impose, pay to the registered owner of the vehicle the rebate that has accrued in respect of that part of that period before the vehicle was reported lost or seized; |

| (c) | if within the eligibility period the new scheme off-peak car is re-registered as a private motor car or a business service passenger vehicle, no rebate shall be payable to the registered owner of the vehicle in respect of that period; | | (d) | if within any rebate period the new scheme off-peak car is re-registered as a private motor car or a business service passenger vehicle, the rebate for that period shall be payable to the registered owner of the vehicle on a pro-rata basis upon the happening of the event; and | | (e) | if within the eligibility period or any rebate period the new scheme off-peak car is declared non-user under rule 53, the rebate for that period shall be payable to the registered owner of the vehicle on a pro-rata basis (discounting any period of non-user) at the expiry of that period. |

|

(7) If the vehicle referred to in paragraph (6)(b) is recovered or released (as the case may be) and the registered owner thereof takes out a licence in respect of the vehicle under rule 38, the Registrar shall —| (a) | where the eligibility period or rebate period during which the vehicle was reported lost or under seizure has elapsed, pay to the registered owner of the vehicle the amount of the rebate that is payable in respect of that part of that period during which the vehicle is reported lost or under seizure upon the taking out of the licence under rule 38; or | | (b) | where the eligibility period or rebate period during which the vehicle was reported lost or seized has not elapsed, pay to the registered owner of the vehicle the amount of the rebate provided for under paragraph (4) at the end of that period. |

|

| (8) Where any vehicle to which rule 33(2) applies is re-registered as a new scheme off-peak car under this rule, the Registrar shall, subject to such conditions as he thinks fit to impose, pay to the registered owner of the vehicle a sum of an amount equivalent to the rebate which would have been payable under rule 33(2) had the vehicle been de-registered on the day before the date of its re-registration as a new scheme off-peak car under this rule, and upon such payment, rule 33(2) shall cease to apply in respect of that vehicle. |

| (9) The Registrar may, in his discretion and subject to such conditions as he thinks fit to impose, waive, in whole or in part, the fee of $100 payable under paragraph (2). |

(10) The Registrar may —| (a) | refuse to make any payment of any rebate provided for under this rule to the registered owner of any new scheme off-peak car unless the Registrar is satisfied that all fees and taxes which are payable in respect of that vehicle under Part I of the Act or these Rules have been paid; or | | (b) | set off any fee or tax which is payable in respect of that vehicle under Part I of the Act or these Rules arising from its re-registration as a new scheme off-peak car against any rebate provided for under this rule which is payable to the registered owner thereof. |

|

| (11) Where a new scheme off-peak car is reported lost through theft or criminal breach of trust or is seized by any authority under any written law, the registered owner of the new scheme off-peak car shall, within 7 days after the loss or seizure, inform the Registrar in writing thereof. |

| (12) Where the Registrar has paid to the registered owner of a new scheme off-peak car who has failed to comply with paragraph (11) any rebate under this rule which such registered owner would not have been entitled to on account of the loss or seizure of the vehicle, the Registrar may, by notice in writing, require such registered owner to refund the Registrar for the amount that has been paid to him within such time as may be specified in the notice. |

| (13) Any registered owner of a new scheme off-peak car who fails, without reasonable excuse, to comply with paragraph (11) or with any notice issued to him by the Registrar under paragraph (12) shall be guilty of an offence. |

|

| Re-registration on or after 25th January 2010 of off-peak cars as private motor cars or business service passenger vehicles |

33F.—(1) As from 25th January 2010, the registered owner of an off-peak car may apply to the Registrar for the vehicle to be re-registered as a private motor car or business service passenger vehicle under this rule.| (2) An application under paragraph (1) shall be made in such form and manner as the Registrar may require, and shall be accompanied by a fee of $100. |

| (3) The Registrar may impose such conditions as he thinks fit when granting an application made under paragraph (1). |

| (4) Where, on or after 25th January 2010, a motor car which has been registered as an off-peak car under rule 32 is re-registered as a private motor car or business service passenger vehicle under this rule, the registered owner of the vehicle shall pay to the Registrar the conversion premium specified in paragraph (5). |

(5) The conversion premium referred to in paragraph (4) shall —| (a) | in the case of an off-peak car in respect of which a category (f) certificate of entitlement has been issued, be the conversion charge computed according to the formula set out in rule 22(1)(b) of the Road Traffic (Motor Vehicles, Quota System) Rules (R 31); or | | (b) | in the case of any other type of off-peak car registered on or after 1st October 1994, be determined in accordance with the following formula: | | | is the sum of the rebate on customs duties granted in respect of that motor car under section 16 of the Customs Act (Cap. 70), the rebate on the quota premium granted under rule 14(2) of the Road Traffic (Motor Vehicles, Quota System) Rules and the rebate on the additional registration fee granted under rule 9(3) or (4) of these Rules, as the case may be, in respect of the motor car at the time it was registered as an off-peak car; |

| | | is 120 months less the period (in months) for which the motor car has been registered in Singapore at the time of its re-registration as a private motor car or business service passenger vehicle under this rule; and |

| | |

|

|

|

| (6) The Registrar may, in his discretion and subject to such conditions as he thinks fit to impose, waive, in whole or in part, the fee of $100 payable under paragraph (2).”. |

|

|

|