| Charities Act |

Chapter 37, Section 48

| Charities (Fund-raising Appeals) Regulations |

| Rg 8 |

| G.N. No. S 176/2007 |

| REVISED EDITION 2008 |

| ( ) |

| [1st May 2007] |

| Citation |

| 1. These Regulations may be cited as the Charities (Fund-Raising Appeals) Regulations. |

| Definitions |

2. In these Regulations, unless the context otherwise requires —

|

| Application |

| Duty to donors |

4.—(1) A charity, commercial fund-raiser or person conducting a fund-raising appeal shall ensure that —

|

| Use of donations |

5.—(1) A charity or person receiving a donation shall use the donation in accordance with this regulation.

|

| Duty to maintain accounting records |

6.—(1) A charity, commercial fund-raiser or person conducting a fund-raising appeal shall maintain accounting records which shall contain entries showing —

|

| Fund-raising expenses |

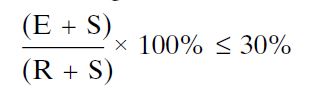

7.—(1) The total relevant fund-raising expenses of a charity for the financial year ending on or after 1st April 2008, and for every subsequent financial year, shall not exceed 30% of the total relevant receipts from fund-raising and sponsorships for that financial year, as determined by the following formula:

|

| Requirements relating to financial statements and audits of charities, and fund-raising appeals of $1 million or more by charities |

8.—(1) A charity shall disclose in its financial statements the total amount of donations received for the period to which the financial statements relate.

|

| Power of Sector Administrator to inspect records |

9. A Sector Administrator —

|

| Power of Sector Administrator to give directions in relation to receipts from fund-raising appeal |

10. A Sector Administrator may give directions to a charity or a person conducting a fund-raising appeal —

|

| Offences |

| 11. Any charity, commercial fund-raiser or person who contravenes any provision of these Regulations shall be guilty of an offence and shall be liable on conviction to a fine not exceeding $5,000 or to imprisonment for a term not exceeding 12 months or to both and, in the case of a continuing offence, to a further fine not exceeding $50 for every day or part thereof during which the offence continues after conviction. [G.N. Nos. S 176/2007; S156/2008] |