No. S 457

| Futures Trading Act |

(Chapter 116)

| Futures Trading (Amendment) Regulations 1997 |

|

| Citation and commencement |

| 1. These Regulations may be cited as the Futures Trading (Amendment) Regulations 1997 and shall come into operation on 2nd January 1998. |

| Amendment of regulation 2 |

2. Regulation 2 of the Futures Trading Regulations (Rg 1) (referred to in these Regulations as the principal Regulations) is amended by inserting, immediately after the definition of “short”, the following definition:

|

| Deletion and substitution of regulation 11A |

| Amendment of regulation 12 |

4. Regulation 12 of the principal Regulations is amended —

|

| Amendment of regulation 12A |

5. Regulation 12A(1) of the principal Regulations is amended —

|

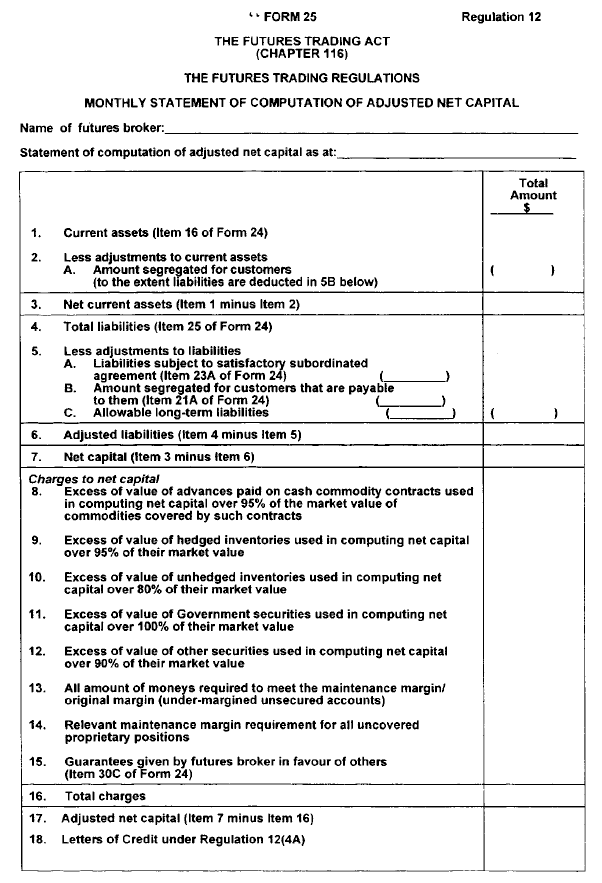

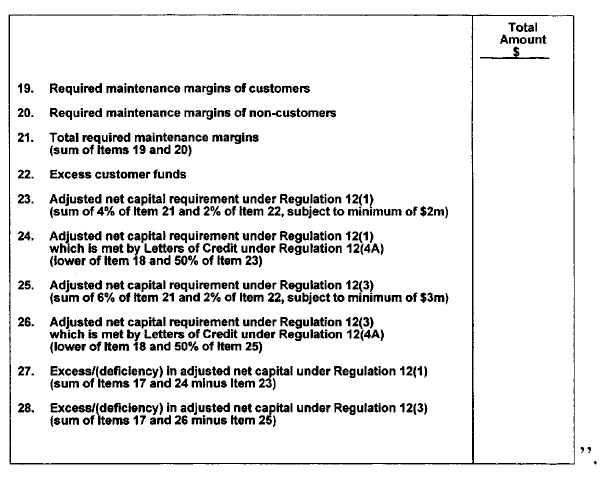

| Amendment of Second Schedule |

6. The Second Schedule to the principal Regulations is amended by deleting Form 25 and substituting the following Form:

|

[G.N. Nos. S 412/94; S 6/95; S 81/96; S 103/96; S 351/96; S 352/96]

Managing Director, Monetary Authority of Singapore. |

| [BFI 010/84 V11; AG/SL/35/94 Vol. 4] |