No. S 482

| Central Provident Fund Act |

(Chapter 36)

| Central Provident Fund (Government Employees) (Amendment) Regulations 2005 |

|

| Citation and commencement |

| 1. These Regulations may be cited as the Central Provident Fund (Government Employees) (Amendment) Regulations 2005 and shall be deemed to have come into operation on 1st July 2005. |

| Amendment of regulation 2 |

2. Regulation 2 of the Central Provident Fund (Government Employees) Regulations (Rg 23) (referred to in these Regulations as the principal Regulations) is amended —

|

| Amendment of regulation 3 |

3. Regulation 3 of the principal Regulations is amended —

|

| Deletion and substitution of regulations 5 and 6 |

| Amendment of regulation 9 |

5. Regulation 9 of the principal Regulations is amended —

|

| Amendment of First Schedule |

6. The First Schedule to the principal Regulations is amended —

|

| Amendment of Second Schedule |

7. The Second Schedule to the principal Regulations is amended —

|

| Amendment of Third Schedule |

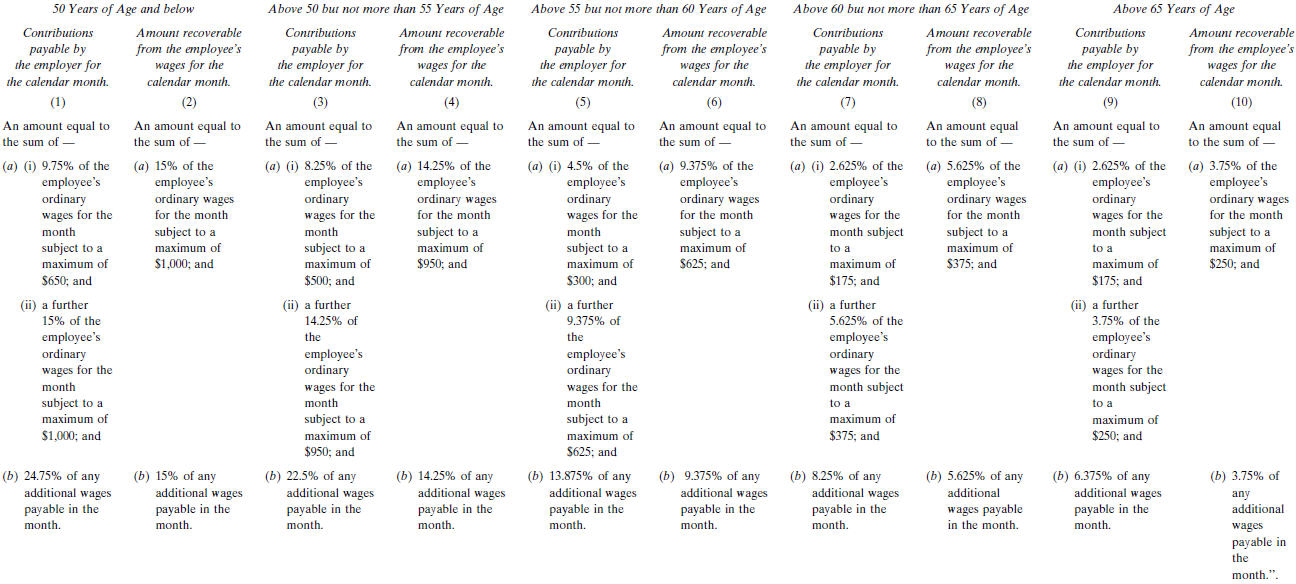

8. The Third Schedule to the principal Regulations is amended by deleting paragraph 1 and substituting the following paragraph:

|

Permanent Secretary, Ministry of Manpower, Singapore. |

| [AG/LEG/SL/36/2005/5 Vol. 1] |

| (To be presented to Parliament under section 78(2) of the Central Provident Fund Act). |